What is customer churn, and how can you improve it?

Nobody likes seeing customers disappear. Maybe they didn’t renew a subscription. Perhaps they didn’t make a repeat purchase. Or, they simply stopped engaging with your business. Whatever the case is, customer churn is a significant concern.

Monitoring customer churn isn’t just a metric—it’s a reflection of the overall satisfaction with your business. Companies with low churn are those that please their customers, create great experiences, and keep people engaged.

Let’s explore why monitoring customer churn is so important, strategies to reduce churn, and detail why retention can be a leading strategy to boost revenue and improve your bottom line.

What is customer churn?

The definition of customer churn is when a customer decides not to be a customer any longer. In short, they stop buying your products or services.

Some amount of customer churn is a natural part of the business cycle, as you gain new customers and lose a few old ones for various reasons. Even the best companies lose customers from time to time, often for reasons outside of their control.

But too much churn is damaging to your business. Acquiring new customers is expensive, and losing lots of previously steady customers indicates potential issues with your products or customer experience.

How to calculate customer churn rate

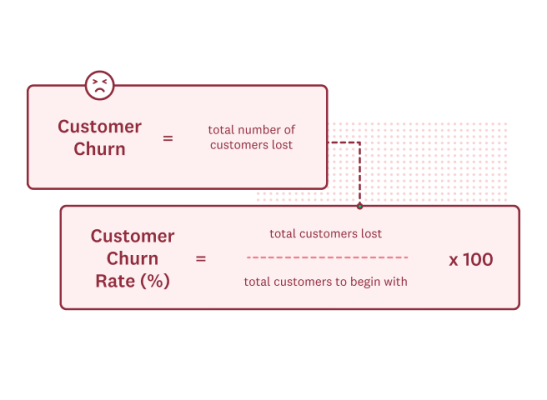

Customer churn is the percentage of customers your organization loses over a given period. In other words, it’s the rate at which your customers stop doing business with your company.

How do you calculate customer churn rate? There’s a simple formula you can use to calculate this important metric.

- Determine a time frame: monthly, quarterly, or annually

- Determine the # of customers you had at the beginning of the determined time frame

- Determine the number of customers that churned by the end of a period of time

- Divide the number of lost customers by the number of original customers

- Multiply the number by 100

Written as a formula, it looks like this:

To help you understand this formula, let’s review a quick example.

Say your organization had 100 customers at the beginning of a quarter. You then lost seven customers by the end of that same quarter. Using our formula, your customer churn rate is:

Reducing a 7% customer churn rate—or whatever yours is—holds significant business implications. For example, it could lead to improved revenue stability, boosted customer lifetime value, and increased revenue.

What is a good customer churn rate?

What exactly is a good customer churn rate? There’s no one magic number here—it depends entirely on your business and industry. However, there are some guidelines that can help you determine where you stand. A 2-8% churn rate is good, or at least acceptable, in most industries. For some businesses, like online retail, the average churn rate can be upwards of 22%.

Knowing where your company stands means researching average and exceptional churn rates for your particular industry and finding out where your competitors stand as well.

Related reading: How to calculate the ROI of customer experience

What causes customer churn?

Customer churn has many different causes, but these are the most common.

Poor customer service

If your customers don’t get the service and help they need when they have a problem or a question, they will be more likely to leave.

Providing excellent customer service isn’t something that’s limited to your new customers only—your long-time ones deserve it as well.

Related reading: 6 tips to improve your team’s customer service skills

Lack of target marketing understanding

Even if your company has been in business for a long time, your customers’ needs will evolve and change. Customers might be looking for new features, more payment options, or even specific membership packages.

You can stay on top of shifting customer needs, preferences, and desires by regularly soliciting customer feedback.

Lack of pricing optimization

When your customers started using your products or services, they were willing to pay the price you were charging them. But as the market changes and competitors enter, or your prices go up after an initial new customer discount, your customers may suddenly go elsewhere—indicating a pricing issue causing churn.

Poor product-market fit

If your churn rate is high, your products might not be a great fit for your audience. You may even be targeting the wrong audience. Create a product roadmap and gather customer feedback to align your product with customer expectations.

Lack of engagement

Some customers might purchase your subscription and not use your product much—or at all. This type of customer can be especially common in the software world.

While you might not mind these low-engagement customers—after all, they’re providing revenue—these people are the most likely to churn. Increasing their engagement and product usage will make a difference for your churn rate.

9 tips to improve churn and drive retention

Reducing customer churn is vital if your churn rate is high for your industry or affects your profitability and growth.

While there’s no single solution to a high churn rate, these steps will help you spot the problems in your business so you can work to solve them to lower your churn rate.

Understand customer needs

You can’t fix a customer churn issue without knowing why customers aren’t sticking with your brand. Uncovering why customers churn helps you pinpoint and resolve significant cross-org issues.

Conducting a thorough customer churn analysis begins with talking to your customers. Gathering their feedback through interviews, focus groups, surveys, and other feedback mechanisms will give you an understanding of their needs and expectations and how well you’re fulfilling them.

Though it’s definitely important to listen to the customers who have churned, don’t limit yourself to only hearing from that group. You should also talk to customers who have stayed loyal and see what they like and find compelling about your products or services. This information can help understand what you’re doing well.

Provide proactive support

Helping new and existing customers get the most value out of your products or services makes them more likely to stay. And offering them proactive support makes that possible.

For example, you may need to revamp or create a thorough onboarding program so that customers can dive right into using all of your product features. Or you may want to develop self-service resources to help customers solve common issues in the customer journey.

But don’t wait for customers to ask for guidance. Instead, proactively use customer feedback data to understand what resources would help customers effectively use your products and services and when and how you can share them for the best results.

You’ll improve the customer experience while also bolstering long-term customer loyalty. You can also use your customer feedback data to provide extra employee training and/or certifications for your staff, so they’ll be better equipped to problem-solve for customers.

Ensure proper audience targeting

Even if you offer a top-notch product, your customers may be churning because you’re not targeting the right audience.

For example, your bookkeeping software could be just what bookkeepers for small businesses need. But if your marketing is targeted toward the small business owners—not the bookkeepers who are more likely to understand the value of your product—then your messaging may not be reaching the right people.

Determining who you’re currently targeting and who you should be targeting will help you close the gaps that lead to churn. Find out who your most satisfied and engaged customers are and compare them to those who churn most frequently so you can see if you have targeting problems and reduce the chance of churn.

Communicate proactively

Customers will stay longer with brands and businesses they feel they can trust. One way to build this trust is to communicate proactively with your customers about current issues, new features, and company news.

Keeping customers up to date and in the loop ensures you create a strong relationship with them. It can also encourage them to adopt new features, which increases the value they get from your product. And they can share big news about your company on their social media channels, giving you some added word-of-mouth marketing.

Know the warning signs of customer churn

What are the warning signs for customers who are likely to churn? You should do a deep dive into the symptoms specific to your business so that you can identify churn risks before they decide to leave.

Low engagement tends to be an indicator of churn potential. For example, if a segment of your customers is only logging into your software product once or twice a month, it’s likely only a matter of time before they leave. Frequency surveys can give you a heads up before things become too critical here.

Another indicator is having unresolved or open customer service issues. Or, if you experience most of your churn around renewal time, your churn could be linked to a pricing problem.

Identifying warning signs that customers are likely to churn will help you uncover the pain points in your customer experience that are driving customers away. It will also help you determine which customers could use a personal touch or additional resources to prevent them from churning before it’s too late.

Enhance the user experience

The customer experience you offer directly shapes your customer relationships going forward. Our state of CX research found that 91% of consumers are likely to recommend a company after a positive experience. On the other hand, 89% of CX pros state that a poor experience is a leading contributor to their company’s customer churn.

The best way to improve your user experience is to truly understand it. Who knows the experience you offer best? Your customers. Turning to your customers and asking for feedback through surveys is a great way to enhance your CX.

For example, you could survey users at different customer touchpoints. Collecting information on how your pre-purchase interactions impact customers will help you streamline your marketing funnel. Alternatively, feedback on post-purchase touchpoints like customer support will help determine how well you’re attending to your customers.

Pinpointing weak spots in your customer experience will lead you toward actionable strategies to remedy them. Over time, small changes can snowball and help you create winning customer experiences.

If you’re not convinced, we suggest you learn more about calculating the ROI of customer experience. Once you have concrete numbers down, you’ll see how powerful a positive customer experience can be.

Related reading: Customer success programs: How to drive impact

Monitor customer engagement metrics

While churn is a critical metric to track for the health of your business, it’s not the only one out there. When tracked alongside your churn rate, these additional CX metrics will give you a fuller picture of your customer experience—including why customers are leaving and what can prevent it.

- Gross Monthly Recurring Revenue (MRR) Churn: This metric is the percent of revenue lost due to customers canceling or downgrading. Gross MRR Churn helps you see if you’re losing high-value customers or if it’s mostly small accounts churning.

- Net Monthly Recurring Revenue (MRR) Churn: This illustrates any overall revenue changes from your existing customers by considering new revenue from expansions or upgrades.

- Revenue Growth Rate: This metric shows how much your revenue is growing monthly and gives you a view of how churn affects your company’s growth.

- Net Promoter Score® (NPS): This powerful and popular metric indicates whether people are likely to recommend your products or services to their friends or colleagues. NPS helps gauge overall customer satisfaction along with churn rate.

- Customer Satisfaction Score (CSAT): This metric reveals how happy customers are with your customer service and can help you determine whether your high churn rate is due to customer support problems.

- Customer Lifetime Value (LTV): This metric shows you how much revenue customers bring during their relationship with your company. It can help you determine if a high churn rate hurts your ability to exceed your initial customer acquisition cost.

Establishing a Voice of the Customer (VoC) program that tracks these metrics will help set you up for success. Low customer engagement and satisfaction are common signs that a customer may churn. Identifying these as early as possible will help you take steps to fix the problem.

Related reading: How to run a successful VoC program

Optimize your onboarding process

A smooth onboarding process is key when setting customers up for success. If customers feel uncertain about actions they should take or don’t understand how to get value from your product, they may churn.

You should ensure you’re offering a detailed and comprehensive onboarding process. There are two great ways you can go about this:

- Put yourself in the customer’s shoes: Moving through your onboarding process and seeing the experience from the customer’s perspective will give you critical insight. You’ll be able to identify gaps and potential pitfalls.

- Collect customer feedback: Use a customer feedback survey after the onboarding process to directly ask what’s working and what isn’t. With that feedback, you can revamp any areas in the onboarding experience that customers say are frustrating.

Alongside these potential methods of improving your onboarding process, you should also make sure you have all the fundamentals covered. For example, a great onboarding process should offer tutorials, guides, and constant support to customers who need it. Anything that helps your customers get started and maximize the value of your offering should be a priority.

Here are a few customer feedback survey templates to get you started.

Build a customer journey map

When thinking from the customer’s perspective, you don’t have to stop at just onboarding. You can develop an entire customer journey map that traces their experience from start to end.

Customer journey mapping identifies all the potential touchpoints where customers interact with your brand. Use surveys to monitor the success of each touchpoint so you can get a big-picture view of the journey you’re offering, streamline every step, and make plans for improvement.

Drive better retention with surveys

Customer churn isn’t just another metric to track—it’s an indicator of the health of your entire customer experience. That’s exactly why you need to monitor it and work to improve it. By using surveys, you can find data-driven methods of improving your CX.

Putting your customer experience at the forefront of everything you do will help reduce churn. Trust us, your customers will thank you.

NPS, Net Promoter & Net Promoter Score are registered trademarks of Satmetrix Systems, Inc., Bain & Company and Fred Reichheld.

Discover more resources

Solutions for your role

SurveyMonkey can help you do your job better. Discover how to make a bigger impact with winning strategies, products, experiences, and more.

Why are surveys important in research?

Surveys are important in research because they offer a flexible and dependable method of gathering crucial data. Learn more today.

NPS surveys: Best practices for high response rates

Learn NPS survey best practices to drive high response rates by improving survey processes.

23 ways to increase CSAT response rates

It's hard to improve your customer satisfaction scores without respondents. Get SurveyMonkey's best actionable tips to improve your response rate.