Forty-two percent of survey users say response rates are their biggest challenge. Low response rates wreak havoc on your margin of error and the reliability of your survey results. Your response rate could mean the difference between a successful and a lackluster product launch.

You don’t have to settle for low response rates, or even worse, inaccurate data, though.

With over 25 million questions answered daily on the SurveyMonkey platform, we know a thing or two about getting people to take surveys.

In this article, discover five proven ways to increase survey responses, backed by research from over 3,000 survey participants.

What’s the best way to get people to take your survey?

“Imagine yourself as your survey's ideal respondent, and think backwards,” says SurveyMonkey Senior Research Scientist Sam Gutierrez.

- Are they able to discover or receive your survey?

- Is it too long for them?

- Is it relevant and engaging?

- What is in it for them?

- Are there certain questions that may be difficult to answer?

Don’t fret. You don’t have to be a senior research scientist to make a highly responsive survey.

We interviewed SurveyMonkey Research Scientists Sam Gutierrez, Zoe Padget, and Wendy Smith, who collectively have 30+ years of research science experience. We also surveyed 3,063 US adults to uncover the best way to get survey responses. Use these tips to get more people to take your survey.

6 ways to get people to take your survey + actionable tips to launch a survey today

1. Choose the right channel and timing to maximize survey response rate

Timing is everything when it comes to survey distribution, and the optimal moment can significantly impact response rates and data quality.

Because every audience is unique, the most appropriate time to send your survey is highly subjective and depends on several factors, including survey context, time zones, and industry-specific norms.

Nonetheless, a good rule of thumb to get people to take your survey is to send it early in the work week—Monday to Wednesday. The caveat is that topical surveys, like a post-event survey, are best sent immediately after an interaction when the experience is still fresh.

Your survey channel also plays a role in getting people to take your survey. Like timing, the best channel to send your survey is dependent on your audience.

Consider these survey channels to meet your audience where they are:

- On-site kiosks can be helpful for in-person events.

- Emails are common for mass surveys.

- SMS can be useful for short post-transactional surveys.

- Social media can be used for fun and spontaneous surveys, or ones targeted to specific groups within forums or online groups.

Related reading: 5 ways to time and send your surveys for better results

2. Keep the surveys short and focused

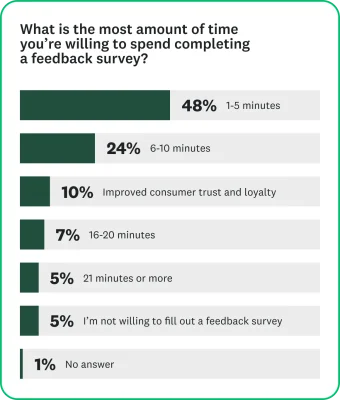

What is the maximum amount of time you’re willing to spend completing a feedback survey?

As a surveyor, your optimism may lead you to take as long as necessary to complete each answer thoughtfully. You would be considered an outlier.

We asked survey takers this exact question. Nearly half of all respondents (48%) answered 1-5 minutes. And 24% of respondents are willing to spend 6-10 minutes completing a feedback survey.

“Longer surveys make the survey experience more burdensome for respondents, and that can impact their attention spans, answer quality, and whether or not they have the patience to complete longer surveys,” according to Gutierrez.

Short surveys, in many use cases, are best.

“Short,” however, is open to interpretation. Different survey question types have different respondent burdens. Open-ended questions take much longer than simple multiple-choice or checkbox questions. A matrix question with 10 rows takes almost as long as 10 separate multiple-choice questions.

So when designing a short survey, consider its time commitment. Will it take 5 minutes to complete, which nearly half of survey takers report wanting to spend on a survey? Or will your survey—filled with multiple open-ended questions—take 21 minutes or more to complete?

3. Make your survey easy to complete

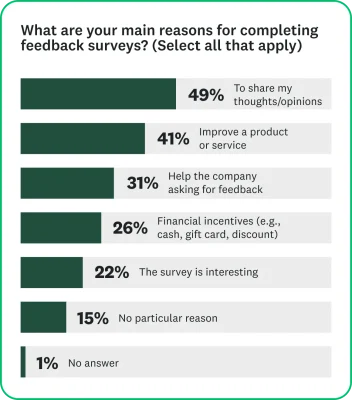

More than half of survey takers (53%) say sharing their thoughts and opinions is their main reason for completing feedback surveys.

Generally, people want to help improve the products and experiences from companies and organizations they patronize. That said, a comprehensible survey is needed to engage survey takers and gather accurate, actionable data.

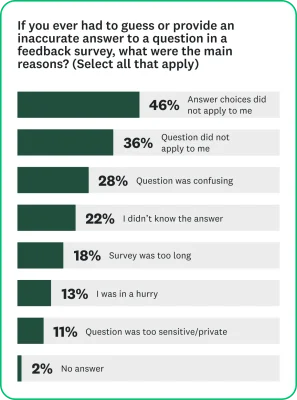

Irrelevant questions and answer options are the leading cause of inaccurate feedback from respondents.

According to Smith, the best strategy is to keep it simple.

- Clear instructions help survey takers understand your objective and how their feedback contributes to the goal.

- Smooth transitions between topics create delineation between questions, eliminating confusion.

- Simple questions reduce survey takers’ mental load and reduce distraction from what you’re trying to measure.

- Question variety can keep respondents engaged in surveys longer because they have to focus their attention each time there is a change to the question type.

Even more, you should consider your online polling experience, especially on mobile devices.

“A majority of respondents in all countries are now taking surveys on mobile, and if the experience is not optimized, unclear, or broken, it will lead to survey drop-out,” said Smith.

Remove barriers, like incomprehensible questions and technical difficulties, to create engaging surveys.

4. Offer incentives to increase response rates

Twenty-six percent of survey takers say financial incentives are among the main reasons for completing feedback surveys.

Incentives can be good for boosting response rates, but proceed with caution. Higher response rates don’t necessarily mean better data quality, and incentives can cause data bias if used incorrectly.

“It’s not possible to eliminate this bias,” says Smith. “You can add quality-trap questions to the survey to remove responses that are not thoughtful, with the intent of eliminating satisficers taking the survey for the incentive.”

And about those incentives—the more specialized your topic and target audience, the greater your incentive needs to be.

Here are the top 3 survey incentives to get people to take a survey, according to our survey experts:

- Cash or cash-value gift cards are considered the strongest incentive.

- Charitable donations can be effective but may lead to bias depending on what you’re measuring.

- Sweepstakes may be effective, depending on the prize, but they can also be legally fraught.

Incentives are great, but be mindful of survey bias and ensure the reward matches the work.

5. Follow up with survey respondents

You are competing with several priorities in survey takers’ lives—work obligations, caretaking, and social lives. Or, they simply forgot. A follow-up reminder can arrive at the right time when survey takers are primed for giving feedback.

But there’s an even greater reason for following up with reminders.

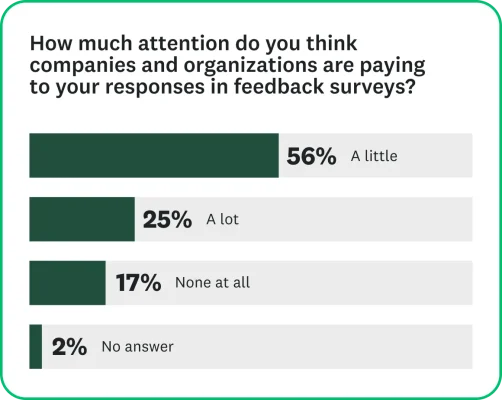

More than half (56%) of respondents said that they think companies pay “a little” attention to their responses.

Survey takers have several reasons why they may respond this way, but there’s one unmistakable reason: They don’t think companies care about their feedback.

A follow-up email reiterating the value of their feedback shows that you do pay attention to their responses, and more importantly, that you care.

6. Say thank you

Take tip number five one step further: Close the feedback loop and say thank you.

Seventy-two percent of survey takers said they don’t hear back from the company after completing a survey. Instead, inform your survey takers of your action plan based on feedback.

You show survey takers the impact of their feedback and encourage customers to fill out future surveys.

Improve survey response rates with SurveyMonkey

Getting survey responses is a science that we’ve perfected. Take it from our experts—choose the appropriate timing and channel for your audience, design short and engaging surveys that people want to take, throw in an incentive to pique interest, and follow up.

It sounds easy, but if you’re still puzzled over where to start, try our expert-made survey templates. Templates are fully customizable and ready to deploy fast. Learn more about your customers with market research survey templates, design customer-centric products with product development survey templates, and improve your customer experience with customer feedback survey templates.

Methodology: This SurveyMonkey study was conducted from June 16-23, 2025, among a sample of 3,063 adults in the US. Respondents for this survey were selected from a non-probability online panel. The modeled error estimate for this survey is plus or minus 2.0 percentage points. Data have been weighted for age, race, sex, education, and geography using the Census Bureau’s American Community Survey to reflect the overall demographic composition of the United States.