Data gathering: What it is, why it matters, and best practices

Get the best results by understanding the most effective ways to gather data during market research.

Data gathering is the most important part of market research. Data collection is more than just asking for information from a random sample of the population. Understanding the methods and processes involved in data gathering ensures that you have reliable and rich data to inform your business decisions.

Data collection enables researchers to extract insights and form evidence-based conclusions. When data is collected strategically, researchers can test their hypothesis and analyze the results.

In this article, we’ll discuss the types of data, steps for collecting data, methods of data gathering, and more to help you prepare to conduct market research.

What is data gathering?

Data gathering is the process of collecting, measuring, and analyzing information from various sources, including surveys, focus groups, analytics tools, and public records. It is the first and most crucial step in the market research process, regardless of the type of research.

It is the systematic collection of accurate and relevant information for a specific purpose, such as evaluating performance, testing a hypothesis, or understanding a market.

5 types of data

Before we discuss data gathering, we need to review the types of data that can be collected. All data can be divided into two categories: qualitative or quantitative. Furthermore, data can be classified as first-, second-, or third-party.

1. Qualitative data

This type of data can’t be measured or expressed numerically. It's less structured than quantitative data. Qualitative data is information acquired to understand more about a research subject’s underlying motivations—answering “how” and “why” questions. It is descriptive information that can consist of words, pictures, or symbols, which is why it isn’t easily measurable.

Qualitative data is obtained through open-ended questions that allow study participants to respond in their own words. When asked in a survey, an open-text box is used for responses.

Examples of questions that will yield qualitative data are:

- How do you feel about using products from XYZ brand?

- You indicated that you prefer product A. Why is that your favorite laundry detergent?

2. Quantitative data

Quantitative data is structured and can be analyzed statistically. In numerical form, the data can be used to measure variables. The results are objective and conclusive. Questions used to collect quantitative data are usually “how many,” “how much,” or “how often?”

Quantitative data can be measured by numerical variables, analyzed through statistical methods, and represented in charts and graphs.

Examples of quantitative research questions are:

- How often do you purchase laundry detergent?

- Once weekly

- Every two weeks

- Once a month

- Other

- How many containers of laundry detergent do you purchase at one time?

- 1

- 2

- 3

- Another amount

Whether you need to conduct quantitative or qualitative research, SurveyMonkey Audience can connect you with the participants you need. This market research solution allows you to specify your target audience's demographics and collect and analyze data efficiently and effectively.

3. First-party data

First-party or primary data is collected directly from your research participants. It’s valuable data because it is gathered directly from your sources, eliminating the risk of misinterpretation and error. First-party data is the most useful and reliable data for your research.

Common sources of first-party data are:

- Survey responses

- Web analytics

- Social media analytics

- Reviews

- Email analytics

- Interviews

- Focus groups

- Experiments

- Observations

The information you can collect from first-party sources includes demographics, purchasing behaviors, interests, purchasing habits, and likes and dislikes.

Second-party or secondary data is data that has already been collected by someone else in the past. It is less reliable because you cannot be certain of the data-collection methodology. It was also performed with a different hypothesis in mind, so analyses may not align well with your research needs.

4. Second-party data

Common second-party data sources include:

- Previous research

- Books

- Professional journal publications

- Websites

- Libraries

- Newspapers

- Public records

Second-party data may be collected before primary data to identify knowledge gaps or augment primary research data.

5. Third-party data

With third-party data, you’re looking at data sets that are put together from various sources. This type of data has usually been gathered by companies that don’t have direct relationships with consumers and is often sold on data marketplaces. The main benefit of third-party data is its greater scale compared to other data types.

Common sources of third-party data include:

- DSPs (Demand side platforms)

- Audience management platforms

- DMPs (Data management platforms)

- Public data exchanges

Importance of data gathering

Why does data gathering matter? Data gathering is a crucial part of market research, providing the foundation for data analysis. According to Hanover Research, “91% of businesses say using market research data increased their sales.” Data, especially market research data, is used to inform business decisions and understand core customer groups.

Accurate data is critical for several reasons, including:

- Informed decision-making: Businesses can make informed decisions using precise data from customers or employees. Whether the data informs product development, customer satisfaction, or some other aspect, it enables businesses to make informed decisions based on facts.

- Improved strategy development: With accurate data, organizations can identify trends and patterns, resulting in more effective short- and long-term strategy development.

- Problem identification: Gathering data enables organizations to identify problems or inefficiencies that may be hard to see without systematic observation.

- Goal tracking and measurement: Data allows businesses and organizations to track progress towards their goals. It helps teams evaluate performance and make adjustments when needed.

- Process optimization: Highlight what’s working and what isn’t using reliable data to drive improvements.

- Customer understanding: Enhance your knowledge of customers by gathering information about their preferences, behaviors, and pain points.

- Accountability and transparency: Clear data records help maintain accountability in reporting, compliance, and communication with stakeholders.

Data gathering methods

Ready to gather some data? There are several ways to collect data for your market research. Let’s look at the most common methods for collecting data, including surveys, forms, interviews, focus groups, observation, and online tracking.

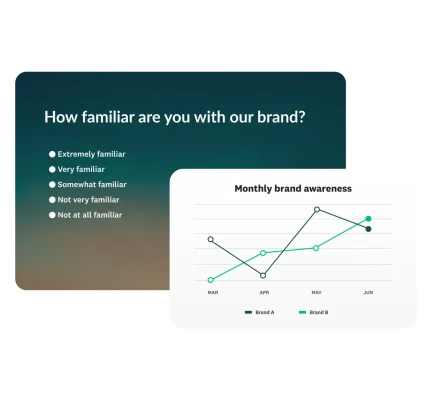

Surveys

Surveys ask customers directly for information to support your research. Surveys can be created with a variety of question types designed to provide you with the answers you require for your research.

Questions may be quantitative, qualitative, or a combination of both. Surveys may be conducted online, via email, telephone, or in person. The easiest, most efficient way to administer surveys is online.

Benefits

- Cost-effective: Sending online surveys is more cost-effective than some other forms of data collection, such as focus groups or interviews.

- Customizable: Surveys are fully customizable and can be tailored to suit your research needs. You can ask a combination of qualitative and quantitative questions to enrich your data.

- Easy to create: With a survey builder like SurveyMonkey, creating online surveys is a breeze.

- Standardized responses: Asking uniform questions makes it easier to consistently compare and analyze results.

Use cases

Market research surveys are affordable and provide reliable information for your research. They can be used for:

- Brand tracking

- Feature importance

- Concept testing

- Packaging design analysis

- Usage and attitudes

At SurveyMonkey, we offer a variety of market research solutions that originate with surveys. We also offer a variety of collection mode options to choose from, including mobile device surveys, SMS surveys, and QR codes.

Forms

An online form can collect a variety of information from research participants. Participants may be asked to fill out their contact information, availability, and more.

Forms are useful for collecting demographic information, gated content, or handling event registration. Depending on what format and tool you use, you may have options for sorting and analyzing your data.

Benefits

- Simple to create: Online forms are easy to build with a form builder and can be customized to match your brand or organization.

- Faster data collection: Responses are submitted instantly, allowing for real-time tracking and analysis.

- Flexible: Online forms can include a variety of fields and question types, such as drop-downs, multiple-choice options, and file uploads.

- Secure and private: Online form platforms, like SurveyMonkey, offer encryption and privacy settings to protect participant data.

Use cases

Online forms are commonly used to collect and manage participant data for future use. They can be used for:

In-person interviews

An in-person interview uses a trained moderator to conduct face-to-face interviews. It is a more expensive and time-consuming data gathering method, but it can yield deeper data as you can ask follow-up questions to better understand their perspective.

Benefits

- View nonverbal cues: In an in-person interview, moderators can look for nonverbal cues and behaviors that support more precise data.

- Ask clarifying questions: Moderators can ask follow-up questions to delve deeper into a participant’s response. The ability to ask clarifying questions on the spot supports stronger data.

- Use physical items: Physical items can aid in reviewing product features during in-person interviews. This is impossible with surveys, forms, and other data gathering methods.

Use cases

One-on-one in-person interviews can be used for a variety of reasons, including:

- Testing new ideas or concepts: Interviews can gauge participants’ reactions to new products, services, or policies before launch.

- Recruitment or screening: Interviews are used in hiring processes to assess candidate fit and communication skills.

- Community research: Policymakers or organizations might use interviews to gather real-world perspectives from those affected by an issue.

Focus groups

Similar to in-person interviews, focus groups for data collection involve face-to-face discussions with a moderator or facilitator. Rather than being individual sessions, the discussions take place in a group. In focus groups, you risk a participant with a strong opinion swaying the others. The moderator must be able to keep the group on task and remain unbiased.

Benefits

- Get qualitative data: Focus groups yield valuable insights that can support your research.

- Reveal underlying attitudes: Open dialogue helps uncover the “why” behind people’s thoughts and opinions.

- Real-time reactions: Use nonverbal cues, observe tone and group dynamics, and watch for body language to enrich insights.

Use cases

Focus groups can be used for a few different purposes, but most commonly are used for:

- Product and concept testing: Focus groups are used to gauge consumers’ reactions to new products or concepts before launch. It helps validate that a product or service will be well-received and worth pursuing.

- Marketing and advertising research: Marketers and advertisers use focus groups to test messaging strategies with consumers.

- Customer experience improvement: Companies can use focus groups to gain insights on how to improve the customer experience.

- Academic or social research: Focus groups are often used to collect qualitative insights for studies on human behavior, communication, or cultural trends.

Customer observation

Observation can take the form of using a tool (analytics) to find out how users behave on your website or in-person observation. In-person observation may involve observing how consumers move through your physical store and interact with products.

Benefits

- Contextual understanding: Observation provides hidden insights and context surrounding customer behavior.

- Drive sales and retention: Insights gathered from customer observation can drive better retention and sales through better product placement and pricing strategies.

- Reveal real behavior: In-person observation reveals how people actually behave, not just how they say they do.

Use cases

There are a few different times when customer observation comes in handy, including:

- Retail environments: Retail businesses can use customer observation to optimize pricing, product placement, and store layout.

- Service interactions: Businesses can gather data on customer service interactions to improve customer experience.

- Website or app analytics: Brands can use heatmaps, session recordings, and user tracking tools to see how visitors navigate a site or app.

Online tracking

Tracking pixels and cookies are used to monitor users’ online behavior. This reveals the content users are most interested in and engaged with. Before you start preparing to use online tracking, you need to ensure you’re using this data-gathering method in a legal and ethical way.

Recent changes have led to changes in online tracking. You now need to ask users to indicate their preferences when they visit your website. If many of your users prefer not to accept cookies, it will make online tracking much less useful.

Benefits

- Cost-effective: Both pixels and cookies are inexpensive (or free) for businesses to use.

- Easy to implement: Setting up online tracking is a relatively simple process that doesn’t take too long to implement.

- Little maintenance: Once they are set, they gather data on their own and need little maintenance.

Use cases

The use cases for online tracking range from understanding user engagement and site performance to retargeting.

- Website analytics: Businesses can glean insights by monitoring page views, session durations, bounce rates, and traffic sources.

- Customer journey mapping: Brands can use online tracking to understand how users move through a site to identify where they drop off or convert.

- Retargeting: Cookies allow businesses to show targeted ads to users who visited their website but didn’t convert.

Data gathering procedure in research

Before you begin data gathering, define your objectives and goals. You must determine exactly what you are looking for so that you have a direction for your research. Then, follow these steps for efficient data gathering.

For example, your objective may be to find out how consumers view your brand. You may test brand awareness, loyalty, recognition, and image to gather data to help you determine your overall brand health.

Step 1: Outline data to be collected

Once you have chosen a hypothesis, measurement, insight, exploration, or another goal for your research, it’s time to determine what information you need to meet your objective. Do you need quantitative data, qualitative data, or a mixed-methods approach to include both?

Step 2: Determine your data gathering method

After you’ve decided what data you need to collect, choose from the various types of data collection methods and settle on the one that is best suited to your research. Consider the information you need to collect, the timeframe for collection, the sample size, and any other aspects of your research that affect how data are collected.

Step 3: Gather data

Once you’ve determined your goal, outlined the data you need, and chosen your data gathering method, it’s time to start collecting data. Follow your data collection methodology to ensure data validity.

If you use SurveyMonkey to collect survey data for your research, we’ll collect the responses for you. Your customizable data dashboard collects data in real-time, so you can view results as they come in. For other data gathering methods, you can use spreadsheets or similar tools to record data.

Step 4: Analyze results

Data analysis is the process of turning raw data into actionable insights. Depending on your research goals, these insights will support and enhance your marketing efforts, enabling you to make informed business decisions.

SurveyMonkey has several analysis features that help you dig deeper into the data. We provide multiple ways to filter results, charts, graphs, crosstab reports, sentiment analysis, benchmarks, and more. If you’ve collected your survey data with us, these analysis tools are right at your fingertips.

5 best practices for data gathering

Here are a few tips and best practices to ensure your data collection is as successful as possible.

1. Define clear objectives

Before you start collecting data, you must define your objectives to guide your research. What are you looking to uncover or explore through the data you collect? Identify exactly what information you need and why to help you choose the right collection method.

2. Use standardized procedures

To ensure data quality and consistency, standardize everything. That means your questions, data collection methods, and data entry processes must be uniform. For example, check that all multiple-choice survey options are formatted identically to capture the most accurate results.

3. Ensure ethical and legal compliance

Protecting user trust is non-negotiable. Always obtain explicit user consent before collecting personal information and rigorously adhere to all relevant data privacy laws, such as the GDPR and CCPA. Ethical and legal compliance isn't just a requirement—it's the foundation of true data integrity.

4. Protect confidentiality

Build trust through transparency and security. Ensure your data collection tools can safely manage personal information. The simplest way to reduce liability is to anonymize responses and steer clear of collecting sensitive details altogether. To cement participant confidence, prepare and share a robust privacy policy detailing your commitment to protecting their information.

5. Regularly refresh data

Periodic refresh is key to long-term data quality. To keep your data relevant and accurate, implement continuous collection and review. You can achieve this by distributing surveys on a rolling basis and performing regular analysis of the information you gather.

Tools for data collection

SurveyMonkey provides an array of tools for effortless data collection. Below are some of the tools available to you.

Survey builder

SurveyMonkey survey builder enables teams to use feedback to guide decisions based on what people really want and expect. Our AI-powered survey platform helps you create and send branded surveys in no time. Start with one of our 400+ templates or write a short prompt and let AI instantly build a survey for you. Send your survey via email, web links, SMS, or QR codes.

SurveyMonkey Audience

Our integrated global survey panel lets you tap into feedback from more than 335 M people across over 130 countries, with 200+ targeting options. It also features an AI-powered bot and fraud detection to ensure you can be confident in your results. Get insights faster and integrate with industry-leading apps from SPSS to Tableau and Microsoft Power BI.

Usage & Attitudes

The Usage & Attitudes solution is designed to help market researchers surface insights quickly. Expert-built, our solution offers pre-written questions that can be fully customized to your business. Get AI-powered insights in as little as an hour and share your findings in a custom report.

Form builder

With SurveyMonkey, you can also build forms to collect data from participants. Whether you are hosting an event or conducting research, SurveyMonkey makes it easy to collect participant information. With accurate data, organizations can identify trends and patterns, resulting in more effective short- and long-term strategy development.

Put your data gathering strategy into action

In market research, data gathering is necessary to understand your target market. There are multiple methods for gathering data, but whichever method you choose, ensure you’re prepared to collect and store it safely and privately.

Data gathering should be guided by your key objectives and aligned with your research goals. Choose the method that makes the most sense for your research and follow best practices to enhance results.

If you’re interested in using the survey method to gather data, SurveyMonkey Audience might be right for you. SurveyMonkey Audience connects you with the target audience you want at the scale you need and collects the data safely. Get started today!

Get started with your market research

Global survey panel

Research services

Expert solutions

To read more market research resources, visit our Sitemap.