The product manager’s CX handbook

The essential elements product managers need to build an agile customer feedback program.

Editor’s Note: This guide was written in partnership with Annette Franz, CCXP, founder and CEO, CX Journey Inc.

Customer feedback is essential for Product teams who want to create products their customers love. But too often, product and CX teams work in silos. A customer experience plan brings the voice of the customer into everyday decisions for Product teams, ensuring their final results are customer-centric. But how can Product teams capture customer feedback and integrate it into their day-to-day work? The key is to listen to customers at scale.

In this guide, you’ll learn how to run an agile customer experience program, from choosing which metrics to track to proving the ROI of your efforts to leveraging customer feedback to solve them.

Understanding the customer’s product experience

We all suffer from “groupthink” and bias when we design the products we work with daily. How do the people using them see their customer journey? Take the time to map customer touchpoints and journeys, identify listening gaps, and survey critical touchpoints for a holistic understanding of the customer’s product experience.

There are several important tools to help you understand the experience that your customers are having with your products: touchpoint maps, journey maps, and feedback and data.

Touchpoint maps

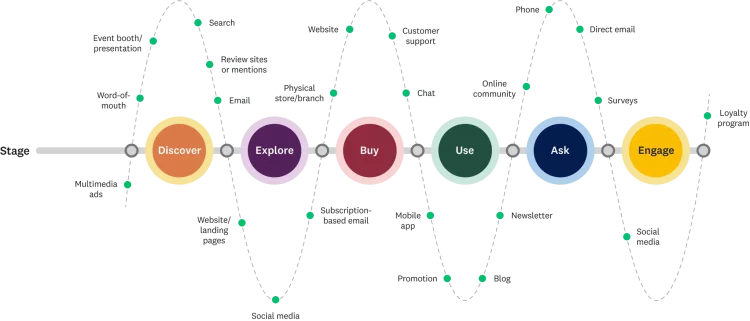

A touchpoint map is a master map that outlines the stages of the brand experience or the life cycle. It captures every touchpoint (i.e., every way the brand engages with the customer and vice versa) and interaction the customer has within each stage.

Interview customers and stakeholders to identify the customer's contact points with the brand within each stage. Touchpoint maps are also excellent vehicles to capture and inventory your current listening posts, identify painful touch points based on customer feedback, diagnose friction and leakage points, and find listening gaps at a high level. Based on this information, the next step is to map the journey to and through the painful or problematic touchpoints.

Journey maps

A customer journey map is a visual representation of the steps customers take for some interaction they had with your company, some journey they were taking to complete a task, and to achieve the desired outcome. It’s a timeline of what customers do, think, and feel throughout the experience.

The map tells the story of the customer’s journey as they interact with your brand while building empathy for them. Once companies understand how they make the customer feel, they can identify gaps in the journey and areas for improvement, fix the pain points, and ensure they keep delivering.

Feedback and data

Finally, listening to customers through surveys across the journey is mission-critical, especially at those touchpoints identified as clear customer pain points. Combining survey insights and online behavior data is another way to learn about their experience. Take the following example—in this case, a SaaS company we’ll call “Bandwidth.”

By capturing feedback at multiple points across the customer journey, Bandwidth can pinpoint the exact moments that cause friction for the customer.

Listening and tracking the customer’s experience helps Bandwidth drill down and determine exactly what needs fixing. For example, when they received negative feedback on a support article, they learned the problem wasn’t with the article but with the product feature itself.

Knowing this allowed them to allocate time and resources to changing the product so that customers no longer require support for that issue. Every interaction on the Bandwidth platform is a transaction; therefore, Bandwidth needs to react to support tickets quickly.

SurveyMonkey provides a quick way to go from feedback to fixes with smart notifications that send feedback directly to those who need to hear it. Set your own conditions based on specific survey answers, custom variables, or custom data from your Contacts. When a survey response meets your conditions, a “trigger” is created and a smart notification is sent via email.

Measuring product satisfaction and NPS

You must understand customer sentiment to identify where to take action and improve the product. Before you embark on a customer experience program, identify which metric(s) you’ll be gathering and tracking and determine which metric best meets the needs of your stakeholders.

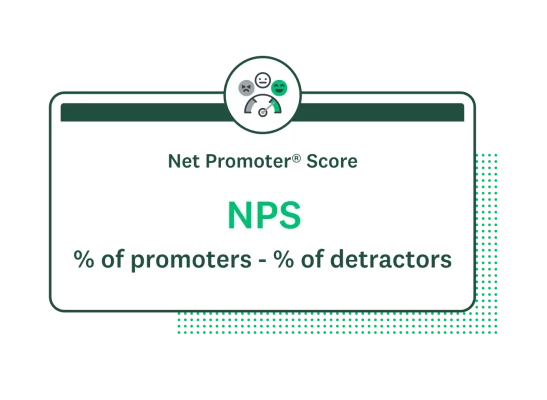

Product teams can capture many metrics, but one of the most popular is Net Promoter Score (NPS®), which is not just a metric but also a survey methodology and a system of action.

The Net Promoter Score is gleaned from asking a single question—“How likely are you to recommend X to a friend or colleague?”—with a scale that ranges from 0 to 10, where 0 = Not At All Likely and 10 = Extremely Likely.

Respondents are classified as follows:

- Promoters rate their likelihood as a 9 or 10;

- Passives rate their likelihood as a 7 or 8; and

- Detractors rate their likelihood to recommend as 0 through 6.

To calculate the score, subtract the percentage of Detractors from the percentage of Promoters. Your score will range from -100 to 100. The higher the number the better, as that means you’ve got far more Promoters than Detractors.

While the score is great to track, remember that NPS is a survey methodology and a system of action. As a survey methodology, you must ask at least one follow-up question that helps you understand the reason behind the score.

Typically, it’s as simple as adding an open-ended question, “What is the reason for that rating?” You can also modify the question to adapt it to the rating given. In other words, if someone rated their likelihood as a nine or 10, you could ask, “Is there something particular that we did to earn your referral?” or “Is there an employee you’d like to acknowledge as the reason behind your score?” On the other hand, if they rated their likelihood low, for example, a three, you could ask, “What did we do to disappoint you?” or “What can we do better to earn your recommendation in the future?”

As a system of action, NPS is rooted in asking and analyzing follow-up questions and attributes about the customer to understand what’s going well and what isn’t. And then, more importantly, it’s about the closed-loop processes you’ve developed to ensure that NPS doesn’t just remain a number but becomes a way of doing business.

In its purest form, NPS is an overall relationship metric. Still, it can be—and is often—used on a transactional basis to understand the impact of the particular transaction, the product, etc., on the customer’s likelihood to recommend the brand. It’s important to view NPS through that lens because you’ll often find that the transactional NPS differs from the overall relationship NPS that you may ask for once or twice a year.

The key is to make that comparison—rather than viewing the transactional metric in a vacuum—and then highlight where (which transactions or interactions) things are going well and where they aren’t so that you can focus improvement efforts on the right touchpoint.

Engaging with customers

Many teams use outdated methods for customer engagement, such as long surveys once or twice a year or individual customer interviews. These have value but need to be more scalable.

There are many powerful tools to understand customers. What’s critical is that these solutions are based on an agile approach that offers continuous in-the-moment feedback and highlights what’s working and what informs their decisions and next steps. Feedback must be received on an ongoing basis to improve the customer experience. Below are several ways to collect continuous feedback pre- and post-purchase.

Consult directly with customers

In addition to surveys, there are many ways to listen to customers and gather their feedback. Product teams often engage in direct conversations with customers. Whether through interviews, tag-teaming with sales, customer success, or support on their customer calls, utilizing customer immersion programs, or showcasing their products at Customer Advisory Board meetings.

Conduct market research

Many companies are complementing feedback collected from customer conversations with market research. It’s now easy and affordable to collect feedback from potential customers in your target audience by sending a survey to an online panel of users. You might want to target users by demographic attributes, like gender, age, or income level; or by company attributes, such as role, department, or industry. For companies looking to expand into a new market, or target a new audience, agile research can be a powerful way to understand the needs of new users who may offer a different perspective.

Implement surveys at critical moments

Remember when product upgrades were done quarterly or even less frequently? Often, it was because that’s how frequently they got customer feedback and market research. Those days are long behind us; now, Product teams can make updates on the fly because they have real-time data from micro-surveys or modals that can help drive real-time fixes and updates. The ability to collect in-the-moment feedback and deploy small, micro-surveys across your platform allows you to scale your feedback program.

As you think about these micro-surveys or modals, consider the goal. What do you want to know, and how will you use what you learn? Consider how you can get feedback in a short, succinct survey. A couple of crucial metrics that you can gather include:

- Customer Effort Score (CES): Use this question to identify how much effort has gone into the user’s experience, i.e., how easy or how difficult was it to accomplish what the user was trying to do? This customer effort question is asked on a seven-point agreement scale (strongly agree, agree, somewhat agree, neither agree nor disagree, somewhat disagree, disagree, strongly disagree), and the wording is as follows (and can be adapted to the specific scenario you are asking about):

- The company made it easy for me to handle my issue.

- It took less time than I expected to handle this issue.

- Customer Satisfaction Score (CSAT): You can’t go wrong by asking customers how satisfied they are with the product, a feature, a use case, etc. It’s a go-to metric for measuring the success of your customer experience. How satisfied the customer is with the user experience of your product or website—down to features and functionality—will certainly affect their overall satisfaction with the brand.

- Goal Completion Rate (GCR): Use this question to understand whether the user could achieve what she was trying to achieve by using your site, app, or product. This is as simple as asking two questions (or variations thereof): (1) What were you trying to do/achieve today? (2) Were you able to achieve that? This is a great set of questions to ask in conjunction with CES.

- Usability: Understanding ease-of-use and usability metrics are essential for the Product team. Questions can be asked as agree or disagree and could range from:

- The app is unnecessarily complex.

- The product is easy to use.

- There are too many inconsistencies across the platform.

- It was quick and easy to learn how to use this product.

One thing that you cannot forget to ask is an open-ended question, the “Why?” behind the rating. Without this, all you have is a score. It’s important to capture further details about the score to understand what to fix or what to keep doing.

Bug reporting

As product managers, bugs are a part of everyday life. But they can affect customer satisfaction and may even lead to churn. Think of our customers as the best QA analysts for anything that slips through the cracks in development. Keep tabs on your “unknown unknowns” with onsite or in-app surveys that allow customers to alert you about bugs right away.

By embedding surveys or forms on your site, in your app, or on your platform, you can gather real-time data and notifications about broken links, site latencies, missing information, and other product issues.

These surveys can sit on your site or app across all pages and act as an avenue of communication for customers to report bugs, ask questions, and even leave compliments. As your canary in the coal mine, these can become early warning signs alerting you to friction and glitches before they become bigger problems that could hurt your brand reputation or lead to churn.

There are many ways to use these types of surveys. Here are some optimization tips for your website or app:

- Survey placement: A survey can be placed anywhere on your website, but we recommend placing it on the right side of the page as the eye naturally moves from left to right while digesting site or app content. This way, the feedback doesn’t interfere with any pertinent information and is easily accessible to the user.

- Consistency: The survey should be persistent throughout your digital platform. Bugs can pop up at any touchpoint, so it’s important to allow users to leave feedback wherever they come across a bug (homepage, checkout page, FAQ page, etc.).

- Generic or specific feedback: Offer the user the choice to leave generic feedback or specific feedback. Specific feedback allows them to provide a screenshot of the issue when they take the survey. You can also offer a custom third option, for example, the option to talk to a representative via live chat.

- Emotional rating questions: When a user wants to give feedback, it will generally be polarized as very positive or very negative. The survey should include an emotional rating question so that you can easily identify and filter the feedback in the back end. Companies often want to filter their feedback to look at all 1-star or very dissatisfied feedback to tackle these issues first.

- Branding: Customize your survey or form to match your brand and tone.

Set up a closed-loop process, both internally and externally, for this type of feedback. Externally, follow up with customers to let them know their input has been received. Internally, you should have a system to receive and follow up on the feedback so that it doesn’t become a check-the-box option, i.e., “We offer feedback surveys on our site. Check.” Take this example as a reason to establish—and to test—that internal process first:

- The platform product manager at Bandwidth discovered a series of feedback items containing the same customer complaint: Post-trial prospects were trying to contact Bandwidth sales to become paying customers. These requests to talk to a salesperson went unanswered.

- The platform product manager realized there was only one channel for post-trial prospects to communicate with a Bandwidth employee, and it was failing. He spoke to the sales director in charge of following up with post-trial prospects. Sales quickly looked into the issue and found a bug in their post-trial workflow. It was promptly fixed, and the sales team began following up with post-trial prospects.

Today, the trial upgrade requests are streamlined immediately to a salesperson. If it weren’t for feedback, they would’ve lost several customers ready to buy, missing out on an available stream of new revenue.

As you can see, it is important to have that internal process and test it to ensure nothing slips through the cracks. To learn more about how to survey your site visitors, read our guide.

Collecting in-app and mobile feedback

Gathering in-app feedback is mission-critical. If your app isn’t working as customers expect, it becomes a pain point in the customer experience. In-app feedback is a way to gather a steady stream of input about the experience so that developers can ensure that the app is always performing optimally.

There are other benefits to asking for in-app feedback. You can capture in-app feedback to test and validate new features, ask for ideas for new features (i.e., understand problems to be solved), and get help prioritizing your roadmap. The outcomes of asking for and using this feedback include increased customer satisfaction, usage, and retention.

SurveyMonkey SDK, our in-app survey option, allows you to create surveys on both iOS and Android that match the look and feel of your app, and. get real-time analytics as feedback rolls in.

You can survey app users at specific intervals, or trigger them when people take specific actions in your app. And if you need to edit or make changes to your survey, it updates in your app automatically without having to resubmit to the app store.

Mapping design decisions to metrics

Mapping design decisions to metrics like key performance indicators (KPIs) is important to support the work that you’re doing. Use KPIs to monitor your product design decisions' success (or failure) to communicate progress clearly.

First and foremost, you’ve got to select the right KPIs. In doing that, consider what metrics matter to:

- You, as the product owner

- Your internal stakeholders

- To the entire organization

While KPIs track the success or failure of the product, they should also link to business outcomes that are impactful to executives. In other words, how does your product's success contribute to the organization's objectives and key results?

As a product manager, some important KPIs include usage, engagement, activity, feature adoption, app retention, product referrals, CSAT, NPS, and CES. At the same time, executives will care about how that translates to growth, new customer acquisition, retention, cost savings, increased revenue, and customer lifetime value (CLV).

To capture these metrics, you’ll use both in-app or in-product feedback and product surveys specific to the details and data you’re trying to gather.

Let’s say you just upgraded your product and added a significant feature. Now you want to gauge both the usefulness and satisfaction with that feature. You can set up an in-product survey to learn how customers feel about it. In that survey, you’ll be sure to ask:

- How satisfied are customers with the feature

- How likely they are to continue using the feature

- How likely are they to recommend the product due to this new feature

Again, establish your goals, and then ask the questions that will allow you to link the design decisions and product changes to those KPIs. Also, ask open-ended questions to get more details about how they feel about the feature.

Or, let’s say that you’ve been tracking product feedback received through a feedback button in your mobile app, and you see a trend in lower CSAT scores. You dig deeper and find that negative feedback is submitted when users are on a specific app page. You also see this point in the app where usage has dwindled to almost zero. You then take that feedback to the team that built that app, and they immediately use it to make modifications to address the issue.

Once you start tracking the feedback again, you see that usage is up, as is CSAT. You also notice a spike in new users signing up for the app. The message is out, the app is awesome, and users are spreading the word. For the business, this translates to increased retention and revenue numbers.

Use the feedback you capture in-product or via other product surveys and listening posts to inform your design decisions. Once you’ve implemented design changes, use the feedback to capture and track the KPIs that indicate whether your changes were successful.

Establishing a customer-centric mindset

When developing your product roadmap and prioritizing customer feedback, take the time to listen and learn from your customers to understand what they want and need from your product. You can also supplement your customer feedback with product development research that allows you to collect data from your ideal target audience that may be outside of your customer set.

Consider this common product development dilemma: Should we develop Product A or B? Should we update, add, or enhance A or B for this product? Could we attract new or more customers by adding a particular feature? How do we prioritize what we include in our feature set?

Studies based on research methodologies, such as MaxDiff or Conjoint analysis, allow Product teams to get objective feedback from the market. These studies can be directed at a target user segment via an online panel representing an ideal customer.

What should product developers prioritize?

In the case of Bandwidth, disjointed feedback and last-minute conversations with sales and support meant that when deciding the future of the product, the person with the loudest voice or the most-compelling argument received their preferred feature or adjustment. There needed to be more broad-reaching customer data to support these decisions, and debates ensued.

Since everyone was making best guesses on improving the product with little evidence or data, this led to tough conversations about which features to prioritize. But, once the team started listening to customers, customer feedback informed all feature prioritization conversations.

Priorities are set based on the feedback customers give per feature request. Bandwidth prioritizes features based on clear data from the most important person: the customer. Whoever has the most feedback on their issue gets their feature built first. Then they use feedback to validate any changes and measure the impact of their work.

Listening to customers on an ongoing basis, hearing what problems they need to solve, and learning how they use your products to solve those problems are all critical to prioritizing product enhancements and new product design.

It’s critical to take the time to listen to customers, develop personas, and always put the customer at the heart of your product development decisions.

Product-centric versus customer-centric organizations

Product-centric organizations focus on building and bringing products to the market rather than focusing on the customers that purchase their products. They develop new products using the latest tools, technology, and processes with consideration for the customer.

Product-centric companies are defined by the products they develop, which may or may not meet customers’ needs. In other words, they find customers for their products rather than products for their customers. They aren’t looking to solve problems or add value, they are looking to extend their product reach to anyone and everyone.

In customer-centric organizations, the customer is at the heart of everything a company does. No discussions, decisions, or designs happen without bringing the customer's voice into it.

Product-centric decisions are based on Product teams or company executives thinking they know what’s best for customers. On the other hand, customer-centric decisions are made based on what employees hear from and learn about their customers.

Aggregate a single view of customer feedback

Product managers want to view the entire customer journey and feedback across all touchpoints in one place. A more centralized, integrated feedback solution lets you see an aggregated view of the customer experience.

Most organizations have multiple streams of customer feedback and data gathered from various departments positioned locally and globally–it’s much more difficult to get a single aggregated view of the experience along the entire customer journey.

It also creates pain for the customer. Remember that your surveys are another touchpoint in the customer experience; they need to be engaging and delightful. When surveys are too frequent, overlap in their scope, or are not timely to the experience the customer is evaluating, frustration ensues for the customer.

A flexible feedback platform allows you to apply quality control and consistency measures across your surveys. It condenses your data, allowing you to create dashboards with role-based permissions to give access to the right people across the organization. Not to mention, of course, that it allows you to create a single view of the customer across the entire customer journey.

The first step in obtaining an aggregated view of your customer feedback is to license a platform that allows you to create just that. Through integrations with over 120 business-critical apps, SurveyMonkey brings customer feedback into your existing tech stack.

Here are just a few ways that CX professionals use SurveyMonkey’s integrations to improve the customer journey:

- SurveyMonkey x Salesforce: Automatically trigger surveys at key touchpoints, take action in-the-moment, and build a 360° view of your customers for your business

- SurveyMonkey x Tableau: Create a central source for actionable customer insights by combining feedback data with operational or behavioral data

- SurveyMonkey x Zapier: Automate manual workflows and take in-the-moment action at scale by integrating customer feedback with hundreds of other apps

You then need to bring together cross-functional teams and align on a voice of the customer (VOC) program strategy and process. Various teams are typically collecting feedback at different touchpoints in your users' journey rather than sharing the wealth of information. Having a holistic approach to feedback analysis provides your organization insight into how your customers feel online and offline.

Behavioral and transactional feedback allows a fuller understanding of your users' sentiments.

Sharing data across the organization

As mentioned before, customer data is ineffective if it sits in silos. How do you share customer insights with the broader organization in a digestible way? There are many different ways to share customer insights. The key is to know and understand your audience.

In the previous section, we wrote about having a flexible platform for your VOC program. That platform is essential for sharing customer insights across the organization, especially when access permissions are role-based, allowing for relevant insights to get to the right people.

There are many other ways to share insights with the wider organization, but be sure to tailor the delivery method and the insights to the audience and the expected and desired outcome.

- At meetings, tell customer stories sourced from comments and survey responses—don’t make it all about charts and graphs. People learn best when information is presented in a story format, especially when it delivers impact to the customer.

- Incorporate customer insights into onboarding, training, and coaching so that employees understand customers and know what they expect, as well as what is expected of them (in delivering the experience or in helping to design a better experience).

- Develop storyboards (or use journey maps) to depict the data's story and the new, desired outcome/experience.

Don’t forget to create a communication plan that includes ways to best communicate within your organization. Not all methods work the same in every company—consider what gets your employees to pay attention and, most importantly, take action.

Showing the ROI of customer feedback

How do you prove the ROI of a design decision and the overall ROI of customer feedback? You need to build the business case and link improvements to the outcomes that matter most to your executives.

The Ask, Listen, Act framework is a continuous, never-ending cycle. You listen to customers through your various survey and non-survey mechanisms. You identify what’s going well and what isn’t. You then share the insights with the departments that need to act on and fix the pain points. And then you listen and measure again to ensure you’ve made a difference for your customers.

It sounds simple, yet it’s not always as easy as that to get the resources—human, financial, capital, time—that you need to effect change from the feedback. As a product manager, you should have a direct line into the impact of the product and the product experience on the contact center. What are service reps hearing about the product? How is the product affecting call volume?

Look at the key metrics that executives are monitoring today—this will be important to building your case. Start gathering feedback from customers by reaching out to customer service. There are many channels to choose from to start, but to keep it simple, you should focus on customers who are calling in for support. From there, you can begin to build your business case.

- How many calls did you receive during that time?

- What’s the cost per call?

- What are the biggest pain points for the customer? What are the estimated costs for fixing the pain points?

- If we make those improvements, what are the estimated cost savings for the business? How will it impact other key KPIs?

- What is the estimated impact on customers?

Once you’ve approved to move forward with an enterprise-wide platform, the heavier lifting begins because now you’re going to be listening and identifying pain points across the organization. Now you’ve got to prove the ROI for other aspects of the business. You’ll use the same approach, but it’s important early on to build that business case so that you have the tools and resources (and the support from your executives) to continue down this path.

Here’s the typical flow for showing the linkage between your CX program and outcomes for the business.

- Listen and analyze customer feedback

- Identify customer pain points and define improvement initiatives

- Highlight the impact of making (or not) the improvements – on employees and customers

- Calculate and demonstrate the linkage between the improvements, the metrics, and the outcomes for the business

- Gather the exact cost for making the improvements and identify the benefits (customer and business) of making the changes in both financial and non-financial terms

- Calculate the ROI

Lather, rinse, repeat. Continue to do this to stay front and center, showing the importance of listening to customers and putting customers at the center of all that you do.

Product management and CX

The product is a vital part of the customer experience. As such, Product teams must work closely with CX teams to ensure that they understand the bigger picture of the experience and the impact the product has on the customer.

These two teams share similar processes to ask, listen, and act on customer data, including their work to understand the customer and their needs, pain points, and problems to solve. But that work is often done in silos, with the CX team focusing on the broader customer experience and the Product team focusing on the product and the user experience, never sharing what they know with each other. It’s time to change that.

Your chief product officer and chief customer officer must champion the customer. As such, they must lock arms and ensure their teams work together, sharing data and designing a great end-to-end customer experience, transforming the business from product-centric to customer-centric.

Net Promoter® and NPS® are registered trademarks of Bain & Company, Inc., Satmetrix Systems, Inc., and Fred Reichheld.

Discover more resources

Customer satisfaction survey templates

Explore our customer satisfaction survey templates to rapidly collect data, identify pain points, and improve your customer experience.

CSAT calculator: Measure and interpret customer satisfaction

Is your company meeting customer expectations? Use our free CSAT calculator to assess your Customer Satisfaction score and drive profits.

Customer Behavior Analysis: A Complete Guide and Examples

Read our step-by-step guide on conducting customer behavior analysis. Learn how to collect data and improve customer touchpoints.

Empowering CX professionals: Using insights to overcome frontline challenges

Empower your CX team with actionable insights! Watch our webinar for expert strategies on boosting performance and morale.