Everything you need to know about the NPS® survey question

Your guide to crafting the right NPS questions for your business to get deeper customer insights and build loyalty.

The Net Promoter Score® (NPS) survey is deceptively simple—it contains just one question. But behind this single question is a long history, plenty of research, and much more information that you should know to use it effectively.

In this guide, we'll cover everything you need to know about the NPS question.

What is NPS?

NPS is a survey methodology meant to gauge the strength of your relationship with your customers and their loyalty to your business. Knowing how much your customers enjoy what your company offers, and how often they sing your praises to others in their network, helps you refine your customer service and product offerings.

NPS is also a powerful way to build long-lasting relationships with your customers, increasing your revenue and reducing churn. To learn more, see how to use NPS surveys to create the best customer experience.

What is the basic NPS question?

NPS is based on one question: “How likely are you to recommend us to a friend or colleague?” The survey respondents then rank their likelihood to recommend you on a scale from 0-10, with 0 being “highly unlikely” and 10 being “highly likely.” You can also add an open-ended NPS follow-up question for your respondents to explain why they gave you the rating they did.

Once your respondents have taken the survey, you’ll separate the ratings into three categories: promoters, passives, and detractors.

- Promoters are survey respondents who selected a 9 or a 10. They love your company and products and are highly likely to recommend you.

- Passives responded with a 7 or an 8. They like what you offer, but are not particularly loyal and may switch to a competitor easily.

- Detractors are those that respond with a 6 or below. They are unhappy with your customer experience and are likely to complain or not return.

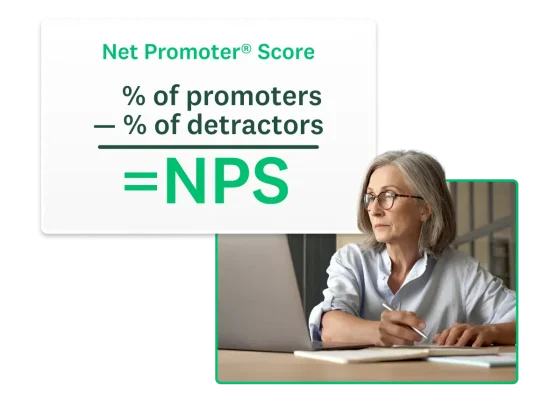

How to calculate NPS

Calculating your NPS score is as simple as the NPS question format. You simply subtract the percentage of Detractors from the percentage of Promoters:

A score above 50 is considered good, while 70 or higher is truly excellent. We have a complete blog post about measuring NPS scores if you’d like to go into more depth on the data.

History behind NPS

The NPS survey was created by Fred Reichheld in 2003. He was a partner at Bain & Company at the time. He wanted to find a way to measure how well an organization treats the people who do business with it. His creation of the NPS score question introduced a way to measure customer loyalty and “likelihood to refer,” which strongly indicates the relationship between a company and its customers.

NPS took off among big corporations and small businesses looking for an effective way to gather meaningful customer feedback. It’s popular for a good reason—high NPS has been shown to correlate strongly with customer loyalty, retention, repeat purchases, and referrals. And all of these factors positively contribute to business growth.

Plus, the simplicity of the NPS question means customers are likely to take a moment out of their day to answer since it’s not a big time commitment.

Behind the NPS question wording

Reichheld and his team at Bain tested many different NPS questions to come up with the final NPS question format, using extensive data from Satmetrix. While at first glance, the NPS question might seem too simple to be truly effective, it is backed by extensive research.

High scores with this NPS question phrasing were strongly associated with markers of business growth like repeat purchases and referrals. A company’s NPS is a good indicator of its future growth. And that’s why NPS has become so highly used among the biggest organizations in the US and worldwide.

Related: Check out key findings from our Net Promoter Score® survey to help you navigate global, cultural, and social differences in new markets.

Can I change the NPS question wording?

The NPS question wording may change slightly, depending on who you’re asking and what you’re asking about. For example, many organizations will use multiple NPS question variations to assess their relationships with clients at multiple touchpoints in the customer journey, and some even survey employees as well.

Examples of NPS survey questions

In general, NPS survey questions will be either relational or transactional.

- Relational NPS (rNPS) questions measure how your customers feel about your organization as a whole. Relational NPS questions help you get a broad understanding of how your customers perceive your brand and their overall satisfaction.

- Transactional NPS (tNPS) questions focus on customer satisfaction in a specific scenario–like after they’ve made a purchase or submitted a ticket to customer support. This gives your teams direct feedback on very specific issues, allows you to measure the effectiveness of your team in terms of customer satisfaction, and, ultimately, optimize each touchpoint to enhance the customer experience at every stage of the customer journey.

Related: Transactional vs. relational NPS®

Re-phrasing your NPS question to match the topic or subject area your survey aims to cover can help you get more accurate answers from your respondents, as you'll see in the NPS question examples below.

1. Business

Asking customers to rate your business is one of the strongest relational NPS questions you could ask. Not only is it simple; it gives you an overview of how customers think of your business as a whole. This question and the comments that follow can give you insight into customer issues or insights that you didn’t even think to ask about specifically.

You can ask: “On a scale from zero to ten, how likely are you to recommend [business name] to a friend or colleague?”

2. Products or services

If you’re looking to get more specific information about how customers feel, drill down and ask about products or services. This approach allows you to evaluate new offerings, assess existing ones, and pinpoint areas for improvement. By gathering detailed feedback on particular features or aspects, you can inform product development, prioritize resources, and track how changes impact customer satisfaction over time.

You can ask: “On a scale from zero to ten, how likely are you to recommend [product/service] to a friend or colleague?”

3. Post-interaction and post-transaction

Measuring customer feedback at different points in the customer journey can provide insight into which areas need improvement. For example, sending an NPS survey after a customer interaction, like a store visit or a purchase can tell you what their experience was like. And you can send a survey after they pay a bill or use your online resources to troubleshoot a problem so you can see how those customer touchpoints are going.

You can ask questions like:

- “Based on your recent purchase, how likely are you to recommend us to a friend or colleague?”

- “Based on your recent interaction, how likely are you to recommend us to a friend or colleague?”

4. Support feedback

Asking customers how their experience with a customer support person or team went can yield valuable insights about how your customer service team is performing. You can set up surveys to go out automatically to customers via email or chat after they contact your customer service team so the experience is fresh in their minds. The answers you receive can help you pinpoint performance issues with specific reps or a whole team, or even a process problem.

You can ask: “On a scale from zero to ten, how likely are you to recommend our customer support service to a friend or colleague?”

5. Employee feedback

NPS surveys aren’t just for your customers—many businesses have started using them to measure employee loyalty as well. Often referred to as eNPS (for employee Net Promoter Score), employee surveys can gauge how much employees enjoy and value working at your company. Employees with high levels of loyalty are less likely to leave your company to find a job elsewhere. And the data you gather from employees can help you adjust unpopular policies, expand popular ones, and get at the root causes of employee dissatisfaction.

You can ask: “On a scale from zero to ten, how likely are you to recommend [company name] as a place to work to a friend or colleague?”

Can I add open-ended questions to the NPS survey?

The beauty of the NPS survey is largely in its brevity, but you can and should ask follow-up, open-ended questions to dig deeper into why customers are or are not satisfied.

After all, once you know how a customer or employee rates your business, products, or staff, you don’t have all the necessary information to make improvements and adjustments. You need to know why they rated you the way they did.

That’s where the open-ended NPS survey questions come in. There is a standard open-ended NPS question that Reichheld originally created, and it’s still popular with many businesses.

- “What is the primary reason for your score?”

This follow-up NPS question is particularly effective for understanding passives and detractors. By asking respondents to explain their reasoning, you uncover the root causes of their scores without influencing their answers. This open-ended approach yields valuable qualitative insights to complement your quantitative NPS, providing a more comprehensive view of customer sentiment and areas for improvement.

Asking for the reason for a customer’s score is also useful for your customer service (CS) team when they’re following up with your Detractors—CS will know the issue before they even contact the customer and be able to address it quickly.

Other qualitative, open-ended NPS questions

But the classic question isn’t right for every situation. In fact, the best NPS questions are often customized to your needs and clients. An effective NPS survey should be customized to align with your goals and target audience.

You can also set up your NPS survey to ask different open-ended questions to respondents depending on their rating. For example, you won’t want to ask a Detractor the same question you’d ask a Promoter.

Using the sophisticated skip-logic options in survey software like SurveyMonkey can help you hone in on the different experiences of your customers. These features enable you to create dynamic surveys that adapt to each respondent's answers, ensuring you ask the most relevant questions and gather more nuanced, actionable feedback.

1. What did you like most about our product or company?

This question helps identify your strengths through the eyes of Promoters. Their responses can reveal unexpected positive aspects, guiding future product development and providing authentic material for marketing campaigns and testimonials.

2. How can we improve your experience?

Particularly valuable for Passives and Detractors, this question uncovers areas for improvement. The feedback allows you to prioritize enhancements to your offerings and overall customer experience, addressing pain points directly.

3. What features did you like the best?

Aimed at Promoters, this question pinpoints specific elements that delight your most satisfied customers. Use these insights to refine your marketing strategy, focus your sales process, and inform product development priorities.

4. What features did you like the least?

This question, best directed at Passives and Detractors, helps identify product weaknesses. It's especially useful when investigating underperforming products or unexpected return rates, providing concrete areas for improvement.

5. What is the one thing we could do to make you happier?

This question accomplishes two important things. First, it helps close the customer feedback loop with your Passives and Detractors so that you can turn them into satisfied customers and Promoters. The phrasing of the question also shows your customers that you care about their happiness and want to delight them, which is always a positive experience.

6. What was missing or disappointing in your experience with us?

Getting customer feedback on what dealing with your company is like is important—both when it’s positive and negative. Ask your detractors what was missing that made them rate you so poorly so you can do better next time, and offer a customer service solution to whatever went wrong in the interaction.

What to do with feedback from the NPS question

Once you've collected responses, analyze the data by segmenting it into Promoters, Passives, and Detractors, identifying patterns and prioritizing issues. Develop targeted strategies for each group: leverage Promoters' enthusiasm, nudge Passives towards greater satisfaction, and address Detractors' concerns urgently. Transforming NPS survey results into actionable insights is crucial for driving meaningful improvements—here's how to do it.

1. Follow up with them through email

If you’re sending out hundreds or thousands of NPS surveys every month, you won’t be able to follow up with each respondent personally. And when you get positive or neutral feedback, you really don’t need to—a simple thank you message after they submit their survey is all they expect.

But when you receive negative ratings and feedback from your Detractors, and they mention a specific negative experience, it’s crucial to check in with them. If it’s possible to fix the issue, your customer service representatives should do so.

Otherwise, offering a sincere apology or a future discount as a peace offering can also be effective. It’s about making your customers feel heard. You might even turn them into a Promoter in the process!

2. Pass the responses into your CRM or Salesforce

Your CRM or Salesforce system holds a wealth of information about your customers—add their NPS data to the list. What this will look like in practice depends on the capabilities of your CRM. You can typically add NPS ratings, gather verbatim feedback, and track scores over time for individuals and customer segments.

You can also use your NPS data to determine trends in your ratings. If you consistently receive very low scores from a particular customer demographic (e.g., men 65+) you will now have a pattern to investigate. This could lead to an adjustment in your product, customer service, or your ideal customer profiles (ICP)s.

3. Leverage open-ended feedback

Open-ended feedback from each NPS category offers unique insights to improve your business. Detractors' comments, while potentially challenging, provide valuable constructive criticism to address weaknesses and prevent public complaints. By swiftly resolving these issues, you may retain dissatisfied customers.

Passives' feedback, typically less emotionally charged, helps identify subtle pain points that prevent enthusiastic referrals. Understanding and addressing these concerns can convert Passives into Promoters.

Lastly, Promoters' feedback isn't just a morale boost; it highlights your strengths and successful practices, offering a solid foundation for further improvement.

To learn more, see how to automate your NPS program with SurveyMonkey.

The NPS question is all about getting actionable data and feedback

Using the Net Promoter Score system is about getting good, clean data you can use to build your business—but it’s also about more than just a number. Your relationship with your customers and their loyalty level is about more than just numbers. They react to how your team treats them, how your products and services serve and fill their needs, and how their relationship with your company makes them feel.

To get started, try out our free NPS survey template.

Net Promoter® and NPS® are registered trademarks of Bain & Company, Inc., Satmetrix Systems, Inc., and Fred Reichheld.

Discover more resources

Customer satisfaction survey templates

Explore our customer satisfaction survey templates to rapidly collect data, identify pain points, and improve your customer experience.

Customer Behavior Analysis: A Complete Guide and Examples

Read our step-by-step guide on conducting customer behavior analysis. Learn how to collect data and improve customer touchpoints.

Empowering CX professionals: Using insights to overcome frontline challenges

Empower your CX team with actionable insights! Watch our webinar for expert strategies on boosting performance and morale.

How to measure & improve CSAT call center scores

Meet customer expectations and create lifelong customers! Learn how to measure call center CSAT and improve customer satisfaction with SurveyMonkey.