Operating system as important as price for consumers when choosing a phone

Price and operating system are equally important to consumers when it comes to choosing their mobile devices, with 30% citing price and 28% the device's operating system (e.g. iOS, Android) as the main reason for selection. Differences, however, arise when looking at cell phone users of Apple, Samsung and other device manufacturers.

Apple's iOS operating system is the primary reason consumers choose the iPhone, while price plays a larger role for users of Samsung and other non-Apple devices.

- 34% of iPhone users cited iOS as their main reason for choosing their device, followed by ease of use (15%), price (13%), and hardware (12%)

- Samsung and other non-Apple users are more likely to select their device due to price, with 33% of Samsung device users mentioning price as their main reason, closely followed by operating system (29%)

- Users of less popular manufacturers, including LG, Google, Huawei, etc. are even more price-sensitive, with nearly half (47%) citing price, and operating system trailing at a distant second (18%)

Verizon customers among the most loyal and satisfied with their cell phone service provider

Across all consumers, nearly half (48%) have been subscribed to their current provider for 4 or more years, while about one in seven (13%) subscribed for less than a year.

- Verizon leads the pack on tenure as the only major carrier with a majority (69%) of customers subscribed for 4 or more years

- Less than half of AT&T (45%) and T-Mobile's (43%) customers have reached at least 4 years of tenure

- T-Mobile is most likely to have newer subscribers, with nearly a fifth (18%) having subscribed for less than a year, compared with 10% of Verizon customers and 12% of AT&T customers

Customer satisfaction and loyalty toward cell phone service providers show a similar story.

- Although most customers (56%) are very satisfied with their provider, Verizon (56%) and T-Mobile (57%) both perform well with their customers, ahead of AT&T where just about half (48%) are very satisfied.

- Verizon also performs well in retention: likelihood to switch is lowest among Verizon customers, with only about a quarter (24%) saying they are very or somewhat likely to switch to another provider in the next 12 months, compared with more than a third (36%) of AT&T customers and 29% of T-Mobile customers.

Within the last 2 years, a third (34%) of consumers have switched cell phone providers at least once. Among those who switched, 44% switched due to the price of their monthly cell phone plans, followed by offers and promotions (23%) and network quality (17%).

Looking ahead, price continues to be the most important factor for consumers who are somewhat or very likely to switch to another provider within the next year.

- 34% cite price as the main reason to switch, followed in equal measure by offers and promotions (25%), and network quality (24%).

- Verizon customers are more likely than the average subscriber to switch for a better price of service (46%), while AT&T customers more likely (33%) due to offers and promotions.

Consumers look forward to 5G, but continue to prioritize unlimited data, network quality, and price

Most consumers are aware of 5G: 61% say they have at least some knowledge about 5G. Those who are aware are also eager to take advantage of its capabilities:

- 60% say that their current cell phone service provides access to 5G

- 68% say it is important for their cell phone service provider to have 5G

- 76% say it is important for their next phone to be capable of 5G

- 61% say 5G will have a positive impact on their lives

AT&T customers are especially enthusiastic about 5G, compared with Verizon and T-Mobile customers. Among AT&T subscribers:

- 78% have access to 5G, ahead of Verizon (71%) and T-Mobile (68%).

- 89% say it is important for their next phone to have 5G capabilities, compared with 78% for Verizon and 85% for T-Mobile customers

- 87% say it is important for their provider to have 5G, compared with 72% for TMobile and 65% for Verizon

- 71% say 5G will have a positive impact on their life, compared with 62% for Verizon customers and only 54% for T-Mobile customers

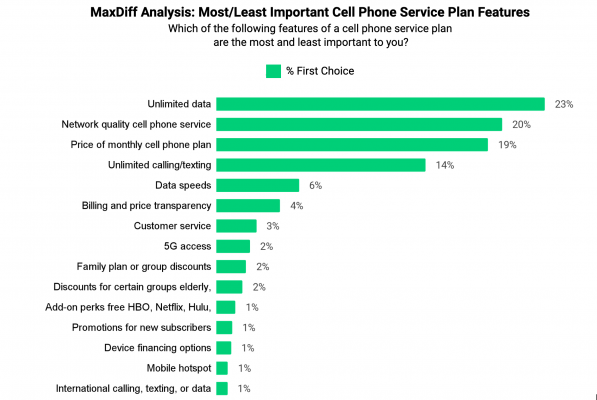

Despite the anticipation for 5G, results from a MaxDiff analysis indicate 5G access to be far less important than more standard offerings that consumers have come to expect. Unlimited data, network quality, and the price of a monthly cell phone plan were the top three most important features; taken together, more than six in 10 people pointed to one of those three features as most important. A negligible 2%, by contrast, demonstrated that 5G access is the most important plan feature for them.

Data privacy a driver of loyalty and customer satisfaction for cell phone service providers

As public conversations surrounding data privacy continue to surface, most consumers (63%) are somewhat or very aware of the types of data that are collected by their provider.

- Gen Z and Millennials are especially attentive, with about 25% of each group saying that they are very aware, compared with only roughly 10% of Gen X and Boomers.

- Only one in five (19%) say they are very confident that their provider is keeping their data safe.

- Trust declines as age increases, with confidence highest (30%) among Gen Z and lowest among Boomers (10%).

Attitudes toward providers sharing data with advertisers and other companies are similarly grim, with more than two-thirds (69%) of consumers saying they are somewhat or very concerned with their data being shared with others.

The resulting implications for cell phone service providers affect the bottom line, impacting both customer satisfaction and loyalty.

- 61% are very satisfied with their provider when they believe their provider is somewhat or very transparent with how their data is handled, while only 48% of those who believe their provider is not so transparent or not transparent at all are very satisfied.

- 64% are very satisfied when they are somewhat or very confident that their data is kept safe, but just 36% of those who are not so confident or not very confident at all are very satisfied.

- 74% of consumers say they are somewhat or very likely to switch if their current provider were engaged in such data sharing practices.

Read more about our polling methodology here.

Click through all the results in the interactive toplines below: