Key findings:

- Big concern over holiday shopping: 43% are worried supply chain issues put a crimp in Christmas, rising to 60% among those who plan to shop online for Small Business Saturday.

- 34% say they plan to shop on Small Business Saturday, up from 30% in 2020, but still below pre-pandemic levels of 39% in 2019 and 44% in 2018.

- Overall, high-income earners and middle-aged adults are most likely to shop at a small business on Small Business Saturday this year.

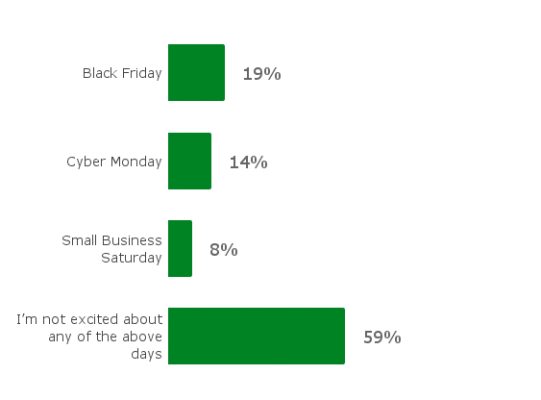

- They’re doing it but it’s not exciting: Most (59%) aren’t excited to shop on either Black Friday, Small Business Saturday, or Cyber Monday.

- Amid supply chain issues, 72% said they’ve noticed an increase in prices in the last three months. Many also report experiencing low or out-of-stock notices (62%), staff shortages at local businesses (55%), and shipping delays (51%).

Shoppers have concerns about supply chain issues

Looming supply chain issues are causing more than four in 10 (43%) adults in the U.S. to say they are worried about being able to purchase the items they want for the upcoming holiday season, according to the 2021 CNBC|SurveyMonkey Small Business Saturday Poll. Those who plan to patronize a small business on Small Business Saturday are particularly concerned about supply chain issues compared to those who don’t plan to shop small (48% vs 42%).

Those who plan to shop online for Small Business Saturday are most concerned: 60% say they’re worried about supply chain issues impacting their ability to purchase the items they want compared with those who plan to shop small in-person (43%).

Consumers are taking note of increased prices

Amid supply chain issues and buzz about inflation, 7 in 10 (72%) say they’ve noticed an increase in prices in the last three months. Many also report experiencing low or out-of-stock notices (62%), staff shortages at local businesses (55%), and shipping delays (51%).

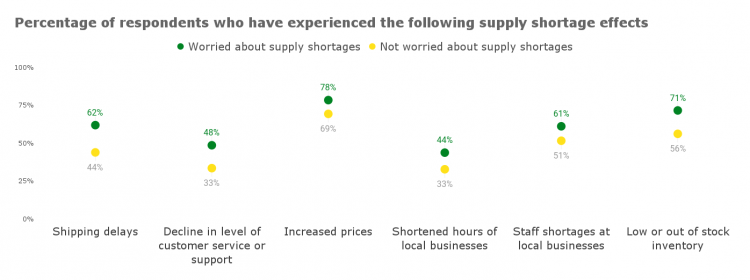

Those who are worried about supply chain issues impacting their ability to purchase items for the holiday season are more likely to say they’ve experienced the effects of the supply shortage, compared to those who seem unfazed about finding items for the holidays. For example, those who have concerns about supply chain issues are more likely to say they have experienced shipping delays (62%) and increased prices (78%) compared with those who aren’t concerned (44% and 69%, respectively).

Participation in Small Business Saturday increases slightly from 2020

A third (34%) of respondents say they plan to patronize a small business on Small Business Saturday, up 4 percentage points from 2020. Despite this slight increase, the number of Small Business Saturday Shoppers is still below pre-pandemic levels. Only 1 in 4 (39%) planned to patronize a Small Business in 2019, down from 44% in 2018.

The biggest increase comes from young adults ages 18 through 24, Blacks and middle-income respondents earning between $50,000 and $99,999.

- 30% of Blacks plan to patronize a small business on Small Business Saturday in 2021, up from 24% in 2020

- 27% of adults aged 18 through 24 plan to patronize a small business on Small Business Saturday in 2021, up from 21% in 2020

- 39% of those who earn between $50,000 and $99,000 plan to patronize a small business on Small Business Saturday, up from 33% in 2020

Overall, high-income earners and middle-aged adults are most likely to shop at a small business on Small Business Saturday this year. Four in 10 (40%) respondents whose household income is $100,000 or more say they plan to patronize a small business on Small Business Saturday, compared with about a quarter (26%) of respondents earning less than $50,000. Similarly, respondents between ages 35 and 64 are also more likely to say they plan to patronize a small business on Small Business Saturday (38%) compared with younger adults age 18 to 34 (27%) and older adults ages 65 and up (35%).

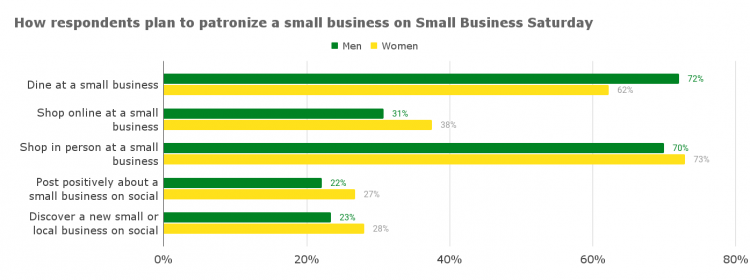

Shopping in-person (71%) and dining (67%) at a small business are the top two ways in which respondents plan to patronize a small business on Small Business Saturday. Men are more likely to say they will dine at a small business compared to women (72% vs 62%, respectively), but are slightly less likely to say they will shop in person (70% vs 73%). Women are more likely than men to say they plan to patronize a small business by posting positively about it on social media (27% vs 22%) or by planning to discover a new small business on social media (28% vs 23%).

Little buzz around Small Business Saturday and Holiday shopping this season

More than half (59%) of respondents say they aren’t excited to shop on either Black Friday, Small Business Saturday or Cyber Monday, down from 65% in 2020 and returning to pre-pandemic levels seen in 2018 (58%) and 2019 (59%). Small Business Saturday garners the least excitement with only 8% of respondents saying they’re looking forward to it, compared to Black Friday (19%) and Cyber Monday (14%).

Age plays a significant factor in whether or not respondents say they are excited about holiday shopping. Younger adults ages 18 to 34 are almost twice as likely to say they are the most excited about Black Friday (34%) compared with adults between the ages of 35 and 64 (15%) and older adults age 65 and up (6%). Older respondents age 65 and up are least likely to be enthused, with 83% saying they aren’t excited about any of the typical blockbuster shopping days.

Contactless payments are popular among shoppers

More than half (56%) of respondents say they’ve used a contactless payment method when shopping in person within the last 12 months. When asked how frequently they opt for a contactless payment method, 4 in 10 (40%) respondents say sometimes, and just 1 in 8 (13%) say always. More than half of contactless payment users cite its ease (57%) and efficiency (54%) as the primary reasons for its use.

Despite its popularity, the majority (70%) of respondents say that they’ll shop at a business regardless of whether or not it offers contactless payment. However, Small Business Saturday shoppers, particularly those who plan to shop small online, are about twice as likely to say they’d be more inclined to shop at a business that offers contactless payments (39%) compared to respondents overall (16%).

Read more about our polling methodology here.

Click through all the results in the interactive toplines below: